Blog

Managerial or entrepreneurial capital? Untangling constraints of innovative entrepreneurs

10 September 2021

Entrepreneurial support programs have been implemented over the last few decades to foster innovative entrepreneurs in developed and developing countries. Usually, these programs are carried out by local business accelerators that provides cash and support services in terms of training, mentorship, access to contacts and more. While there is some evidence that these type of interventions can foster innovative entrepreneurs, it is still unknown what are the mechanisms that drive the ventures’ growth.

Gonzalez-Uribe and Reyes (2020) explore whether providing support services (training, mentorships, etc.) and no cash has an impact on a venture’s success. This paper finds that innovative entrepreneurs face different constraints besides financial ones. Entrepreneurs that received non-monetary support increased their annual sales by 66% during the three following years after the intervention. However, it is still not clear how those interventions affect the entrepreneurs. Is it because it provides them with managerial capital (a la Bloom and Van Reenen, 2010; Bruhn, Karlan, and Schoar, 2010) so they can run their businesses more efficiently? Or is it because it provides them with entrepreneurial capital (a la Gonzalez-Uribe and Leatherbee, 2018) so that they can discover and capture valuable opportunities more effectively?

A managerial capital intervention focuses on how to run the current company as efficiently as possible, while an entrepreneurial capital intervention will focus on exploring, validating, and capturing market needs and business opportunities. On the one hand, if entrepreneurs lack managerial capital, the intervention should help entrepreneurs to implement organisational changes such as the establishment of concrete routines, the creation of specific incentives for employees, or improving inventory management. In contrast, an intervention based on entrepreneurial capital should help founders discover and capture higher value opportunities for their products and services, much like how the lean startup method induces founders to come up with new business ideas and converge faster on the viability of their ideas (Leatherbee & Katila, 2020). This can be done by providing entrepreneurs with mentors who have an entrepreneurial mindset (e.g. Sarasvathy, 2001; Busenitz and Barney, 1997) and consulting services oriented towards the exploratory stages (as opposed to the exploitative stages) of business creation.

Having a better understanding of the different effects of those treatments in entrepreneurships would allow policy makers and ecosystem business accelerators to better gauge innovative entrepreneurs’ constraints and how to lift them. Are entrepreneurs creative people who are able to create innovative products or services but lack management practices? Or are they management savvy people who need to experiment, discover valuable opportunities, and develop effective business models?

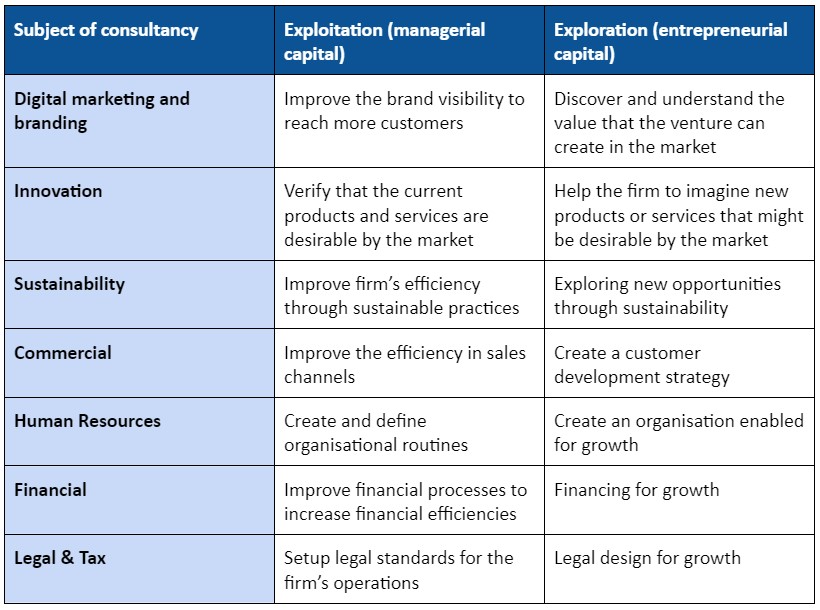

This project aims to answer these questions by implementing a Randomised Control Trial (RCT) in Colombia in collaboration with the Cali Chamber of Commerce (CCC). This RCT will provide entrepreneurs with differential treatments: one aimed at improving management practices and making the established opportunity more efficient (i.e. exploitation), while the other one will be aimed at discovery, validation, capture and scaling of novel opportunities (i.e. exploration). Table 1 shows the main objectives that the program will try to achieve across the different areas of the business by treatment arm.

Table 1. Subjects and objectives of consultancy sessions.

About the program

Cali Chamber of Commerce and iNNpulsa Colombia join forces as partners to implement a new phase of the ValleE methodology in 12 regions in Colombia, to accelerate up to three hundred and sixty (360) early-stage ventures. The 360 beneficiaries’ firms that would be part of the program will pass a rigorous selection process where their level of innovation and the scalability of their business model will be evaluated by experts in the entrepreneurial ecosystem. Those beneficiaries will be randomly selected and placed into two treatment arms, one focused on increasing managerial capital, while the other one will focus on entrepreneurial capital. The intervention will be split into two phases:

This program will have two phases:

- Phase 1: The 360 beneficiaries will be randomly assigned into one of two groups. 180 firms will receive treatment with a managerial capital focus and the other 180 firms will receive treatment with an entrepreneurial capital focus. All beneficiaries’ firms could participate in up to 5 bootcamps that will provide the minimum content necessary to close any knowledge gaps that might exist across different topics like business strategy, digital marketing, market validation, financial enlistment, and commercial strategy. The difference in treatment will come from the consultancy sessions that the entrepreneurs will receive. The entrepreneurs, along with the program facilitator, will identify the area of the business with the most pressing needs. Based on that area, the entrepreneur will select from a menu of consultancies that are available based on the treatment arm. For example, within the finance category, while the managerial capital treatment will make available a consultancy that will help the entrepreneur create or adjust the cash flow of the business, the entrepreneurial capital one will provide the firm with a consultancy to explore how different financing sources can (positively or negatively) affect the growth of the business.

- Phase 2: during the second phase of the program a DemoDay will be held, where the best 75 firms of each treatment arm (total 150 firms) will be selected to continue with the program and receive more focused support. Each firm that passes through to the second phase will receive an additional 10 hours of consultancy that can be distributed across different sessions within 5 months. Those consultancies will focus on the objectives mentioned in table 1 based on the treatment arm that the entrepreneur was assigned.